GTS: Global Highlights & Risks, September 2020

The coronavirus outbreak has devastated the travel and tourism sector, with global travel demand forecast to drop 57% in 2020. As destinations have started to reopen borders and lift restrictions on the movement of their citizens, there has been as increasing emphasis on the travel and tourism industry’s recovery.

Travel corridors and “safe travel” lists have emerged as popular methods to facilitate pent-up travel demand while preventing another major outbreak. However, the resurgence in cases across Europe and Asia Pacific highlights that a serious threat of a ‘second wave’ remains, which would further devastate travel demand and protract the travel recovery. Therefore, international arrivals are not forecast to surpass 2019 levels again until 2024.

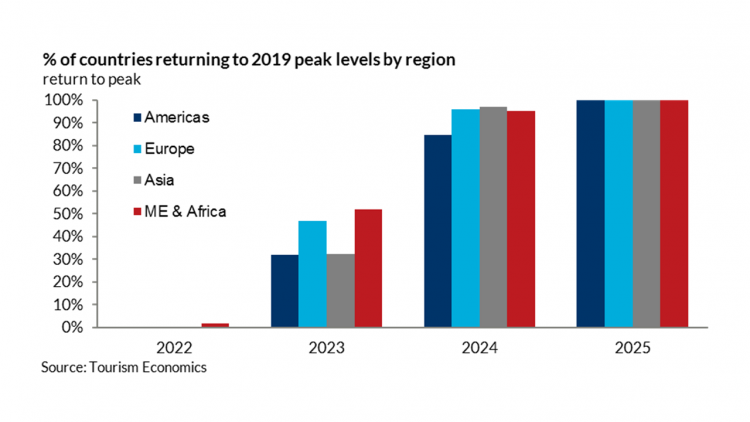

All regions will see a substantial drop in visitor arrivals, with the Americas forecast the largest decline in international travel at 64%. The Americas will also experience the most protracted travel recovery, with only 84% of countries in the region expected to return to 2019 levels by 2024.

Asia Pacific is forecast to be the second worst affected region as countries within the region have taken a more cautious approach to reopening their international borders. Travel demand to Asia Pacific is set to drop 57% in 2020, however, the region will see the quickest rebound in travel demand, with 97% of countries surpassing 2019 levels by 2024.

European travel demand will suffer a 56% decline in visitor arrivals in 2020. However, the region’s swift action to kickstart its tourism industry means that almost all European countries (96%) will return to 2019 levels by 2024.

International arrivals to the Middle East & Africa are also forecast to see a 56% drop in 2020. Given the less severe spread of the virus throughout the region, 95% of countries are set to return to 2019 levels by 2024.

City tourism has also taken a massive hit as a result of the global pandemic causing many tourists to stay away from densely populated areas, while the sudden drop in business travel has diminished travel activity in many city destinations. While 93% of countries are expected to regain 2019 levels by 2024, only 80% of the cities covered within our Global City Travel Service (GCT) will have regained this benchmark. This negative travel outlook for city destinations is in stark contrast to the prior concerns of overtourism which were being felt among popular city destinations, such as Barcelona and Venice.

Asia Pacific is forecast to see the highest share of cities returning to 2019 levels by 2024 at 89%. China, the source of the outbreak, will see 80% of its cities returning to pre-coronavirus levels by 2024.

Within the Americas, US cities are expected to lag significantly in recovery, with only 70% expected to return to 2019 levels by 2024. The top 3 US destinations for international arrivals in 2019 (New York, Los Angeles and Orlando) are not expected to surpass or match 2019 levels until 2025.

Only 72% of European cities covered within the GCT database are expected to regain 2019 levels by 2024. This is due to the protracted impacts on business travel and continued antipathy towards highly populated destinations but is also partly related to the large number of UK cities covered within the database. The UK has suffered the highest number of COVID-19 related deaths in Europe, with UK cities set to face a prolonged travel recovery as only 12% of cities are forecast to return to 2019 levels by 2024.