Bullseye Forecast: STR, Tourism Economics Nail Hotel Room Demand and Occupancy Recovery Predictions

Recovery forecast issued in 2020 proves spot on three years following the pandemic.

Issue Date - 1/23/2024

WAYNE, PENNSYLVANIA—A joint U.S. hotel recovery forecast issued in 2020 by Tourism Economics and STR has proven spot on in demand and occupancy despite the unprecedented forecasting challenges posed by the pandemic.

Tourism Economics, an Oxford Economics company, is a recognized leader in economic forecasting for the travel and tourism industry. STR, a CoStar Group company, is the global hotel industry’s leader in data benchmarking, analytics and marketplace insights. Tourism Economics and STR have partnered on industry forecasts since 2011, consistently ranking among the most accurate industry prognosticators.

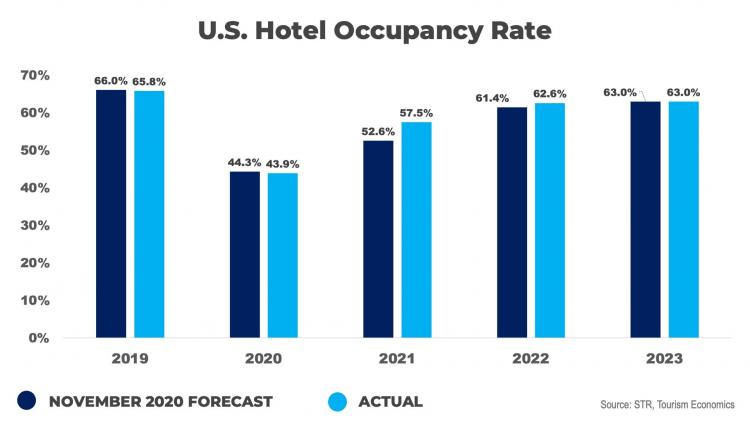

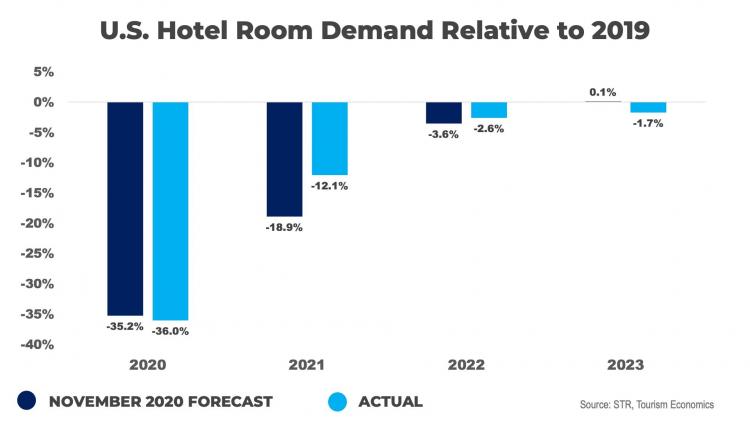

The U.S. hotel performance benchmark forecast was released during the virtual NYU Hospitality Investment conference in November 2020. At the time, U.S. hotel occupancy rates were hovering around 40%, as COVID-19 cases surged and vaccines and at-home tests were not yet available. Amid these challenges, STR and Tourism Economics projected the following:

- 2020 Projection: Daily demand to return to 2019 levels (3.5 million room nights) in early-2023.

- 2023 Result: Three years later, actualized full-year results from 2023 showed exactly 3.5 million room nights on average, just 1.7% below 2019 performance.

- 2020 Projection: Hotel occupancy rate to reach 63.0%* in 2023.

- 2023 Result: The U.S. Hotel occupancy rate landed at an exact match of 63.0%.

Adam Sacks, President of Tourism Economics, reflected on the November 2020 forecast sharing, “Our predictions acknowledged the bleak conditions of travel in the early days of COVID-19. However, we were convinced that the innate human desire to travel would drive a full recovery in time. While certain segments and destinations remain below pre-pandemic levels, the overall market has recovered as expected.”

Higher than anticipated inflation and historically strong revenue management have driven healthy gains in average daily rate (ADR), resulting in a more robust recovery in revenue per available room (RevPAR) than expected. However, the November 2020 demand and occupancy forecasts presented an accurate view of the volume of travel over a future three-year horizon. “Travel forecasting serves an essential role in informing critical short- and long-term goals and strategies for businesses worldwide,” said Amanda Hite, STR president. “We are pleased that our forecasts continue to be a beacon for our industry.”

Aran Ryan, Director of Industry Studies with Tourism Economics further highlighted the forecast’s significance stating, “The travel sector maintained strong interest in our quarterly hotel sector outlook and accompanying narrative throughout recovery. It’s heartening to see the forecast accuracy prove out and guide the industry through uncertain times.”

*The 2020 estimate utilized the standard calculation of occupancy, rather than the total-room-inventory occupancy that was temporarily implemented at the time to account for closures.

Contacts:

Geena Bevenour, US Marketing Manager, Tourism Economics | Email: gbevenour@oxfordeconomics.com

Haley Luther, Communications Manager, STR | Email: hluther@str.com

Media Inquiries:

Shreena Patel, PR & Communications Officer, Oxford Economics | Email: spatel@oxfordeconomics.com | Tel: +44 7999 379025 (London)

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base of over 300 leading companies, associations, and destinations with direct access to the most comprehensive set of historic and forecast travel data available. Our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models to help drive better marketing, investment and policy decisions.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.

See here for a printable version of this press release.

###