Strong Rebound of U.S. B2B Exhibition Industry Continues

The Center for Exhibition Industry Research (CEIR) announced that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording strong improvement in the fourth quarter of 2023.

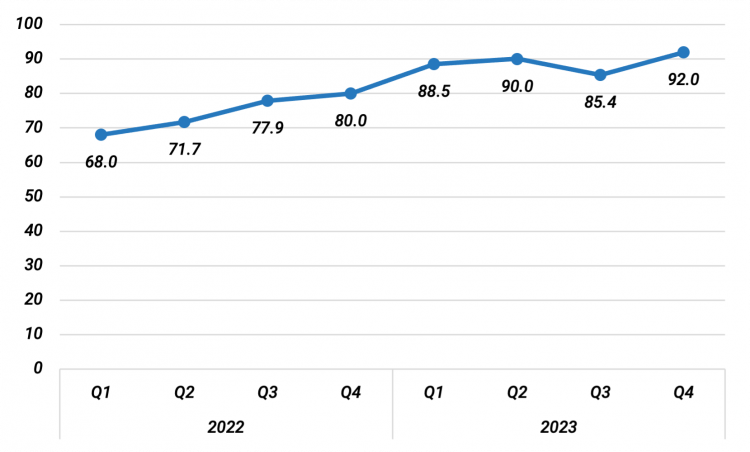

Extremely low cancellations and continued improvement in metrics outcomes for completed events boosted the Q4 2023 Index value to 92.0 (Figure 1). As expected, the CEIR Total Index—a measure of overall exhibition performance—continues to recover, surging 15.0% from a year ago.

Figure 1: CEIR Quarterly Total Index (Index, 2019=100)

CEIR has teamed up with Tourism Economics, an Oxford Economics Company, as its consulting partner for exhibition industry performance-related research, where Tourism Economics has taken on the role of tracking and analyzing U.S. business-to-business (B2B) exhibition performance. CEIR CEO Cathy Breden, CMP-F, CAE, CEM, stated, “I am pleased with the smooth transition of Tourism Economics producing the CEIR Index. The bench strength of the Tourism Economics team is evident, assuring the reliability of quarterly, historical benchmarks. The CEIR Index Report for 2023 will be published in late April, including a forecast outlook through 2026.”

Performance registered just 8.0% below the same period in 2019, marking a substantial gain compared to the past two years, which included a 41.0% shortfall in Q4 2021 and a 20.0% deficit in Q4 2022. As evidence of recent momentum, the Q4 CEIR Total Index gained 6.6 percentage points compared to Q3 2023.

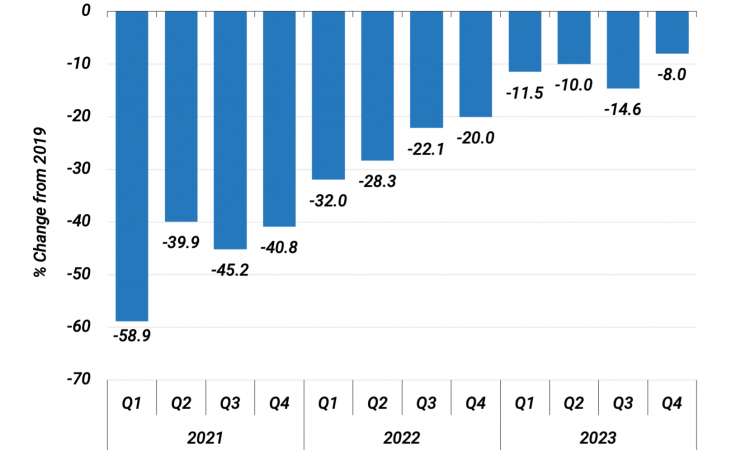

Figure 2 illustrates exhibition industry performance for events occurring between Q1 2021 and Q4 2023, compared to the same quarter in 2019. The latest results for Q4 2023 show a rebound after a weaker third quarter. Among all events in the Index sample, 31.0% have surpassed their pre-pandemic levels of the CEIR Total Index. This represents a jump from Q4 2022 when only 23.0% of events held in that quarter surpassed 2019 results.

Figure 2: CEIR Quarterly Total Index Relative to 2019

The cancellation rate for in-person events remained low at 1.4%, on par with the cancellation rate of 1.3% in Q4 2022, and a significant improvement from 14.8% in Q4 2021.

“The latest CEIR Index readings confirm the resilience of exhibitions,” said Adam Sacks, President of Tourism Economics. “The industry has full recovery in view with the Index just 8.0% below pre-pandemic levels, showing the enduring importance of exhibitions to company performance.”

Q4 2023 CEIR Metric Performance

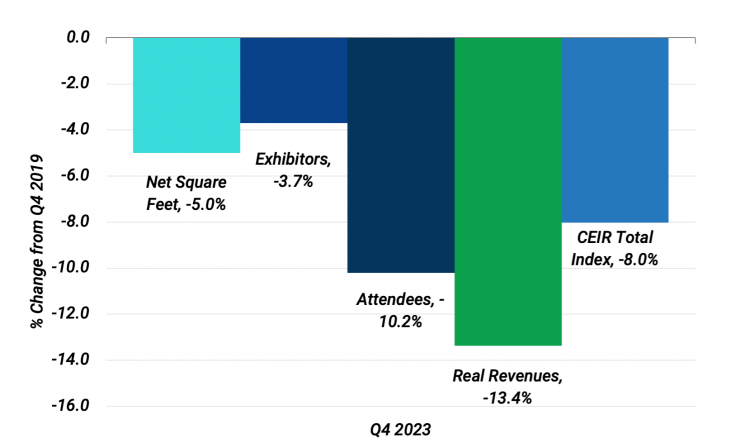

Figure 3: Q4 2023 CEIR Metrics Relative to Q4 2019

Among the four components of the Total Index, the Exhibitors metric has recovered the most, at just 3.7% below Q4 2019; followed by Net Square Feet (NSF) with a decline of 5.0%. Attendees and Real Revenues have been slower to recover from Q4 2019, with declines of 10.2% and 13.4%, respectively. Despite nominal revenue being 3.7% higher than 2019 levels, higher costs eroded the value of exhibition income in inflation-adjusted terms (i.e. adjusting nominal revenue for inflation showed that real revenues still trail 2019 by 13.4%).

The U.S. Economic Outlook for 2024 Continues to Improve

A strong labor market, moderation in inflation, and the easing of financial market conditions have all played a role in fueling recent growth.

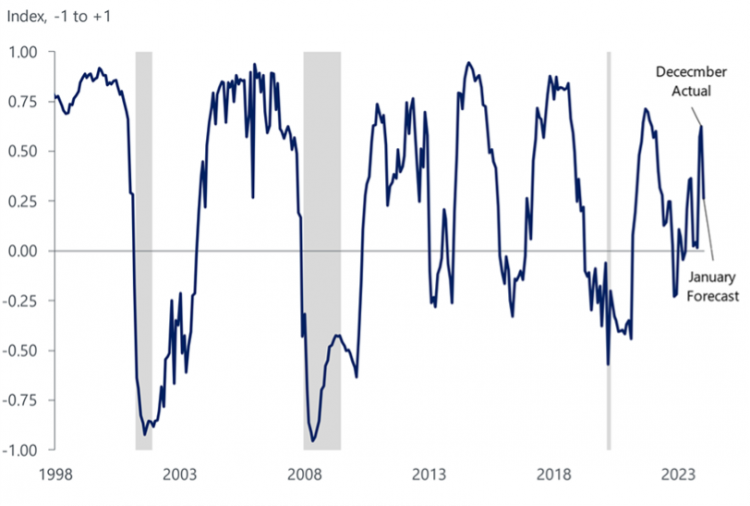

Oxford Economics’ business cycle indicator (BCI) is signaling that the economy continues to show resilience, as this index staged a robust recovery throughout Q4 and recorded its highest reading in two years in December 2023 (Figure 4). Gains in the BCI were broad-based in December. Strong gains in personal income continued to translate into higher levels of consumption. Better-than-expected industrial production in December also contributed positively to the BCI, thanks to mining's resiliency and gains in motor vehicles and parts, as more automotive suppliers return to normal operation.

The outlook for the economy remains modestly positive because of the strength of the labor market, looser financial conditions, and healthy household and non-financial corporate balance sheets. Oxford Economics’ subjective odds of a recession remain low, at 30.0%. Key downside risks include significant weakness in the supply side of the economy, consumption weakness as households exhaust savings, and investment suffering more than anticipated from fiscal policy uncertainty. Additional downside risks include greater-than-anticipated shocks from geopolitical tensions and trouble in commercial real estate, primarily office space.

Figure 4: Oxford Economics' U.S. Business Cycle Indicator

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base of over 300 leading companies, associations, and destinations with direct access to the most comprehensive set of historic and forecast travel data available. Our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models to help drive better marketing, investment and policy decisions.

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

Media Inquiries:

Geena Bevenour, Marketing Manager, Tourism Economics | Email: gbevenour@oxfordeconomics.com

Mary Tucker, Sr. Communications & Content Manager, CEIR | Email: mtucker@ceir.org

See here for a printable version of this press release.

###