US Inbound Travel's Continued Decline Amid Sentiment Challenges

The forecasted 8.2% decline in annual international arrivals solidifies as headwinds persist.

New data through June confirms a continued downturn in international travel to the United States. According to Tourism Economics’ latest forecast, international overnight arrivals are projected to fall 8.2% in 2025 as persistent sentiment headwinds weigh on travel decisions.

The sharpest drop has come from Canada, where overall visits are down 23.7%* year-to-date. Land crossings alone have contracted 28.0%, marking the fourth consecutive month of 30%+ declines. Air arrivals from Canada are down a more modest, but notable, 13.3%.

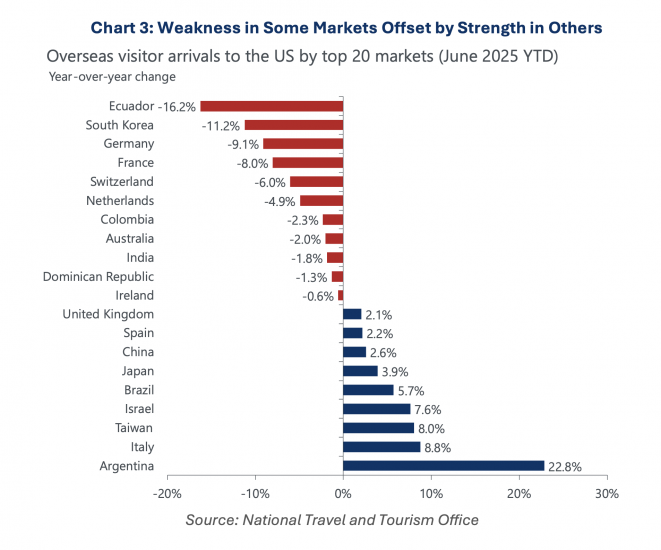

Overseas markets are faring somewhat better, with arrivals down 1.2% year-to-date. June’s 3.4% year-over-year drop reflects a normalized view of travel following the timing effects of Easter earlier in the year. Among top markets, Ecuador (-16.2%), South Korea (-11.2%), Germany (-9.6%), and France (-8.0%) posted the largest losses. These declines have been partially offset by growth in Argentina (+22.8%), Italy (+8.8%), Taiwan (+8.0%), Japan (+3.9%), and China (+2.6%)—a sign of ongoing pent-up demand in some regions.

Behind the softness: a swirl of geopolitical and policy-related concerns, including aggressive trade rhetoric, immigration restrictions, and travel warnings. These have contributed to a perceived unpredictability that continues to influence global travel sentiment toward the US.

Cities with heavy reliance on Canadian visitation are bearing the brunt. Seattle is forecast to see a 26.9% drop in international overnight visitors this year, followed by Portland (-18.3%) and Detroit (-17.3%). In some destinations, Canadian travel accounts for over 90% of the projected international visitation loss.

Key Takeaways:

- US international overnight arrivals forecasted to decline 8.2% in 2025

- Canadian visitation down 23.7% YTD, driven by a 28.0% plunge in land crossings (*now -25.2% YTD since July 2025)

- Overseas visitation down 1.2% YTD, with significant drops from key European and Asian markets

- Forecast revisions show overseas visits to remain 15% below 2019 levels this year

- Negative sentiment and weak bookings suggest continued headwinds for the remainder of 2025

- Download the full July 2025 Inbound Outlook briefing for detailed charts and insights

Download the full PDF research briefing here >